History and Transformations of the Petroleum Sector in Cuba: Nationalizations, Subsidies, and Changes in Supply

Energy Crisis in Cuba

In the 1950s, refineries and thermoelectric plants in Cuba processed oil from the United States. This sweet crude oil was exported at a relatively low price since U.S. refineries were not designed to process it efficiently. On Saturday, August 6, 1960, the Cuban state nationalized foreign refineries because these refineries refused to process Soviet oil, which would have violated their existing supply contracts. The Cuban state also denied them the foreign currency needed to import crude oil.

Refineries Nationalized in 1960

The nationalized refineries included:

Betot: owned by ESSO, with a capacity of 35,000 barrels per day, built in 1957 at a cost of 30 million dollars.

Shell: with a capacity of 25,000 barrels per day, built at a cost of 25 million dollars.

Texaco: with a capacity of 20,000 barrels per day, built at a cost of 20 million dollars.

Additionally, there was a fourth state-owned refinery with a capacity of 20,000 barrels per day.

From this point on, oil imports from the Soviet Union began, covering up to 98% of the country’s needs. According to studies by Carmelo Mesa-Lago, Soviet fuel subsidies reached 6.6 billion dollars.

With the end of Soviet subsidies, Cuban thermoelectric plants began using unrefined domestic fuel with a high sulfur content, which constituted a serious violation of operational standards and caused accelerated deterioration of the facilities. The period beginning in 1991, known as the “Special Period in peacetime,” was marked by a systematic reduction in electricity generation capacity.

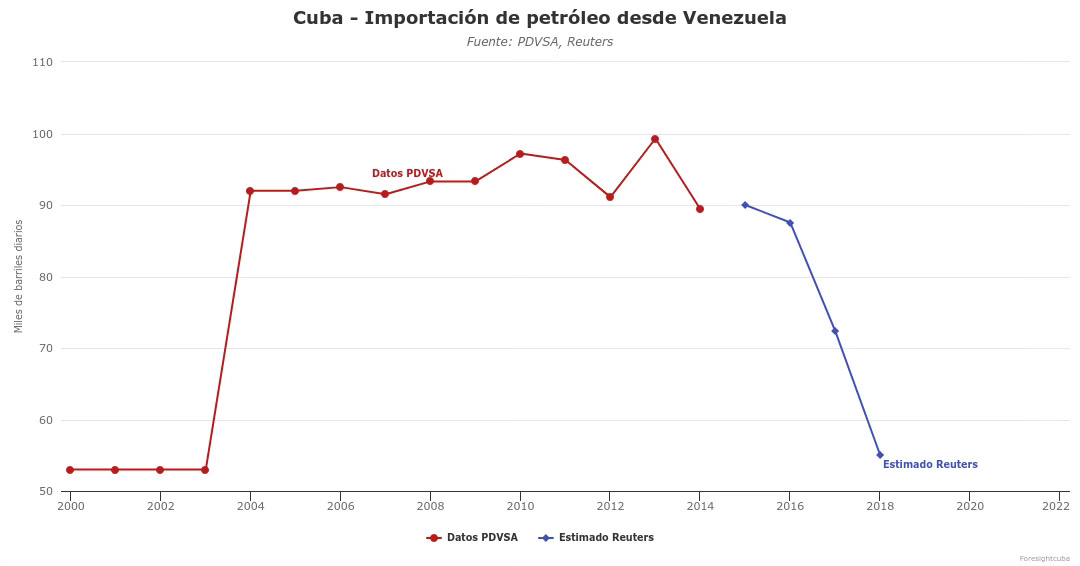

The significant increase in cooperation between Cuba and Venezuela began in 1999. In 2002, a strike at PDVSA protested military control of the company, leading the Chávez government to dismiss 15,000 striking workers. In 2004, Petrocaribe was established to export Venezuelan oil at subsidized prices. Besides agreeing on prices below the world market level, an exchange of oil for presumed medical services was permitted. During this period, the importation of power generators also began to replace the thermoelectric plants.

PDVSA became a socialist state-owned company in 2012, a year in which it sent 105,000 barrels per day to Cuba. This amount gradually decreased to 47,000 barrels per day by 2018. These quantities were reported in its annual financial statements, which stopped being published after 2016. According to the International Energy Agency, oil production in Venezuela fell from 3.4 million barrels per day to 0.55 million in 2020.

That same year, Venezuela stopped paying its debt to China. Previously, in 2017, it had stopped paying its debt to Russia, which at that time amounted to 3.2 billion dollars. Between 2007 and 2016, China loaned Venezuela 62.15 billion dollars, securing the loan with future oil supplies, so Venezuela receives no revenue from crude exported to China. Additionally, it is estimated that Venezuela's external debt reached 187 billion dollars in 2022, and the current debt with China is estimated at 25 billion dollars.

Venezuela’s oil exports to Cuba have been reduced to a minimum due to the drastic drop in production, the plundering of PDVSA's funds (with 17 billion dollars stolen between 2020 and 2023), sanctions imposed by the United States, and China’s demands to receive as much oil as possible as payment for its debt.

Due to the foreseeable economic crisis in Venezuela, and particularly within PDVSA, the Cuban government began planning to obtain oil from Mexico to replace the reduction in Venezuelan supplies. Although there is no official information regarding this supply from Mexico, it appears this has been happening since 2012:

On April 11, 2012, an energy cooperation agreement was signed between the governments of Cuba and Mexico. On December 1, 2018, López Obrador's presidential term began, with Díaz-Canel being one of the few heads of state present at his inauguration. On May 8, 2022, another cooperation agreement was signed in areas such as specialist training, research, vaccines, and medicines. Additional contracts were signed, and by 2024, 3,800 doctors were added to the 1,200 initially agreed upon in 2022.

In May 2021, it was announced that PEMEX would acquire 50.005% of Shell's shares in the Deer Park refinery in Houston, a deal that was completed on January 20, 2022, giving PEMEX full control of the refinery. Additionally, the National Infrastructure Fund paid off the remaining 596 million dollars of the debt corresponding to PEMEX’s 50% share.

In 2020, illegal fuel imports from the United States to Mexico represented 14% of the market, a figure that increased to 27% in 2022. This fuel entered Mexico through falsified customs invoices, declaring the product as lubricant to avoid import taxes. More information can be found on the Mexican news site Código Magenta.

In December 2023, Texas congressmen Vicente González, Dan Crenshaw, and Henry Cuéllar sent a letter to Katherine Tai, U.S. Trade Representative, demanding action against fuel smuggling, which was estimated to be 418 billion Mexican pesos. Following the letter, fuel smuggling decreased considerably.

After the United States closed its land border to smuggling, transportation began by sea to the port of Altamira, where the fuel was unloaded at nearby facilities with rudimentary systems, directly from the ships to the tankers. There is no public information about the potential transfer of some of this fuel to Cuba, but this coincides with the reported "increase in fuel shortages."

Between July and December 2023, Gasolinas Bienestar reported in its annual report the shipment of 16,800 barrels of oil and 3,300 barrels per day of derivatives to Cuba, with an estimated value of 372 million dollars. In October 2023, the U.S. Export-Import Bank canceled an 800 million dollar loan to PEMEX due to the shipment of fuel to the island. In October 2024, another 400,000 barrels of oil were sent under the concept of "humanitarian aid."

Regarding oil extraction on the island, in 2011, an area was created within the Mariel Special Economic Zone. This zone was divided into 59 blocks, of which 22 were contracted to foreign oil companies, such as Repsol-YPF, PDVSA, and the Vietnamese company Petro Vietnam. The Cuban government announced that geological studies estimated reserves of 20 billion barrels of oil. In 2019, the state-of-the-art semi-submersible platform Scarabeo-9 drilled wells in the area, although none of the projects were successful. In practice, oil extraction in Cuba decreased by 37% between 2003 and 2020, reaching 2.37 million tons in the latter year. In 2023, the “Alameda 2” well was drilled in block 9 of Matanzas, with "positive results," although this has not improved the fuel supply necessary for electricity generation.

The causes of the current energy crisis include the absence of an energy strategy and investment in the sector, a lack of resources to purchase fuel, as well as a policy aimed at obtaining it in exchange for presumed medical services. It is also affected by the dependence on political agreements and decisions made by foreign leaders, which go against the interests of their own countries.

Sources: ONEI, International Energy Agency

Spanish: Foresightcuba